Your data pipelines are more fragile than you think— and your next vendor swap will prove it

Here’s something your vendors will never put in a sales pitch: every time you swap a major tool—your CRM, your ad platform, your marketing automation system—you aren’t just changing software. You’re also triggering a quiet crisis in your data warehouse that often won’t reveal itself until months later, when someone tries to look at a report that crosses the date you made the switch.

I’ve seen this happen at organizations of every size. The new tool is live, the team is trained, leadership is happy—and then six months later an analyst pulls a year-over-year comparison and says “I’m not sure we can trust these numbers.” That moment is expensive, and it’s almost always preventable.

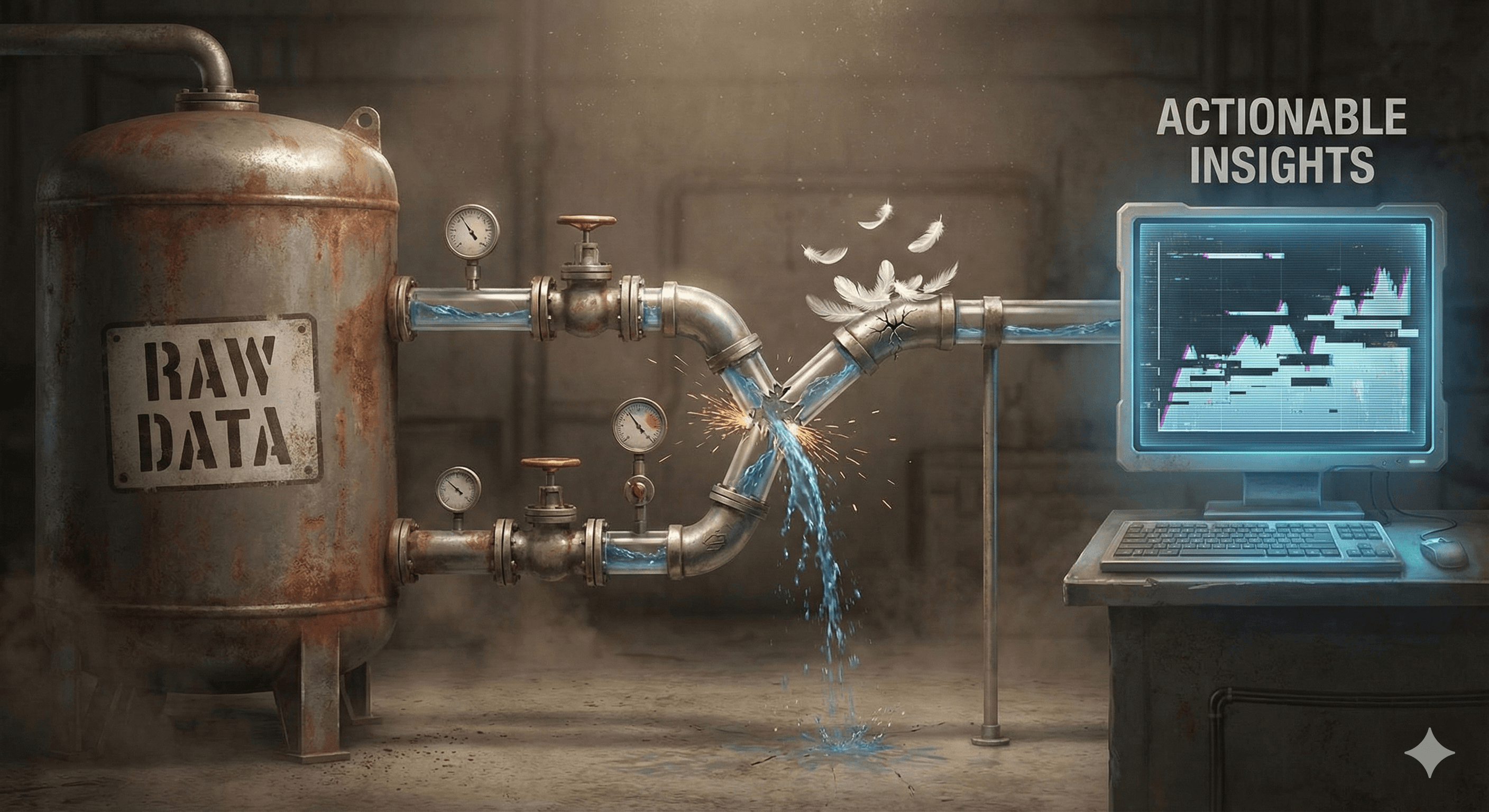

Your data stack is plumbing, not a database

Most executives picture their data warehouse as a big container where data lives. A more accurate picture is that it’s the end point of a lot of pipes—pipes that someone had to build, and that someone has to maintain every time you change what’s flowing through them.

Those pipes are called data pipelines. They pull information from your marketing platforms, your CRM, your ad networks, and push it into a central place where your team can query it and build reports from it. Building them is real engineering work. And they are, by nature, brittle.

They depend on APIs that your vendors control and change on their own schedules. They depend on field names staying consistent. They depend on authentication credentials that expire. If your vendor updates their API and renames a field from “campaign_id” to “ad_campaign_identifier,” your pipeline might break entirely—or worse, it might silently start dropping data you had no idea you were losing. Loud failures are annoying but fixable. Silent failures are the ones that get you.

Loud pipeline failures are annoying but fixable. Silent ones—where data quietly stops flowing without an error—are the ones that cause real damage.

Want to learn how to detect these silent failures routinely & before they cause major headaches?

What actually happens when you swap a vendor

When you move from one major tool to another, the data schema changes. The shape of what gets recorded—and what it’s called—is different between the old system and the new one.

Your old CRM called the field “deal_stage.” Your new one calls it “opportunity_status.” These are almost certainly the same concept, but they live in different columns with different names. Your historical data and your live data no longer connect. Any report that tries to answer a question about pipeline trends across the transition date is now doing a kind of improvised translation that probably has errors in it. This gets even trickier when you are talking about analytics data, where new campaigns, new website features, and other elements are getting added and modified frequently and often without much fanfare.

Historical data migration makes this worse. Vendors will typically hand you a CSV export of your old data and call it a migration. What actually happens is that relationships between records get broken, timestamps shift or get dropped entirely, and the data that arrives in your new system is subtly (or not so subtly) different from the data in the old one. I’ve seen organizations spend months untangling this after the fact when it could have been caught with two days of planning upfront.

The definition problem nobody mentions in the contract

Even if the migration goes perfectly, you still have to deal with the fact that different tools define the same business concepts differently.

What counts as an “impression” on Google is not the same as on Meta. What your ad platform calls a “conversion” might be meaningfully different from what your CRM records as a closed deal—even if they’re nominally the same event. Attribution windows differ. Session definitions differ. What counts as “engagement” varies by platform in ways that feel minor until you put the numbers side by side. You'll run into this all the time with a data warehouse, because you are now suddenly in charge of things like the channel definition for paid social vs organic social. Instead of Google making that choice for you, now you get (have?) to make that definition yourself.

When your data warehouse ingests data from multiple sources, those differences don’t automatically get reconciled. You end up with a report that shows three different conversion numbers from three sources, and nobody can agree on which one to act on. (The frustrating answer is that they’re all right, just measuring slightly different things. That answer doesn’t make meetings go faster.)

What this actually costs

The bill for poorly-managed vendor transitions shows up in a few ways. Reports that span the transition date become unreliable. Year-over-year analysis becomes meaningless if the two years were measured by different tools with different definitions. Your data team spends an enormous amount of time not analyzing anything—just cleaning, reconciling, and explaining discrepancies. Your reports get more complex, where they have to pull data from time period X -> Y one way, and data from period V -> W using a different query & methodology.

And over time, you get something worse than bad data: you get a team that doesn’t trust the data. That’s a really hard thing to fix. Once leadership starts treating every report as “maybe accurate,” the analytics function loses its ability to drive decisions, which is why it exists in the first place.

The good news

These problems are predictable and preventable. The organizations that handle vendor transitions well aren’t doing anything exotic—they’re just asking the right questions before the switch happens instead of cleaning up after it. That means auditing their existing pipelines, understanding how historical data will be handled, running both systems in parallel for a period, and agreeing on metric definitions before anyone signs a contract.

None of this requires a massive technical team. It requires someone who knows what questions to ask and when to ask them. (That’s often the part that’s missing.)

What vendor changes are on your roadmap for the next 12 months? I’d love to hear what your current setup looks like heading into those transitions—the gap between “we switched tools” and “our data still makes sense” is often where a lot of quiet pain lives.

If any of this is ringing a bell, feel free to reach out. This is exactly the kind of thing I work through with marketing and product teams before it becomes a problem.

Chat with the author

If you'd like to make a connection and perhaps collaborate on something:I'd love to talk with you!No matter if you want to build your professional network,or think there might be a great opportunity to to work together or partner.